You might like to Believe Refinancing the borrowed funds In the event your Lover Dies

Sometimes, heirs are finding it difficult, otherwise impossible, to deal with the mortgage servicer just after a spouse becomes deceased. It pick it’s hard locate facts about the loan, like how much arrives and you can where you can improve commission. Plus, servicers features usually refused to give mortgage variations so you’re able to someone but titled consumers once the a keen heir wasn’t a party on mortgage bargain and you can, ergo, failed to get into an amendment agreement.

Today, an excellent CFPB laws provides “successors when you look at the attract” an identical defenses under government mortgage upkeep statutes as modern borrower. (several C.F.R. , twelve C.F.R. 1026.2(a)(11).) Therefore, a verified replacement within the notice is good “borrower” getting reason for the real Estate Settlement Methods Operate (RESPA) losses mitigation rules. (twelve C.F.R. .)

It means whenever you are a replacement for the desire, you can buy information regarding brand new account and apply to own a beneficial loan modification or any other loss minimization option, even though you have not yet assumed the loan. Whether or not, you might have to suppose the mortgage meanwhile you get a modification.

Which qualifies given that a replacement inside desire. Individuals who meet the requirements since a successor for the interest try essentially the identical to people secure beneath the Garn-St. Germain Act. Especially, a good “successor in the attract” was a person who get possessions as a consequence of:

- a transfer from the develop, ancestry, otherwise operation out of rules into loss of a joint-tenant otherwise tenant because of the totality

- a transfer to a member of family pursuing the death of a borrower

- an exchange the spot where the mate otherwise pupils of your own debtor become a manager of the home

- a transfer because of good decree out of a dissolution out-of relationships, court break up contract, otherwise out of an enthusiastic incidental possessions settlement contract, which this new spouse of your borrower becomes a holder regarding the house or property, or

- an exchange to the an enthusiastic inter vivos have confidence in which the borrower are and you may remains a beneficiary and you can and that cannot relate to a beneficial transfer regarding legal rights from occupancy regarding assets. (a dozen C.F.R. ).

The latest servicer need communicate with you. Once the servicer need certainly to reduce a replacement from inside the desire because the an excellent debtor, it should, among other things:

- punctually choose and you may keep in touch with surviving family relations although some exactly who keeps an appropriate demand for your house and you may

- provide information about the loan and (if appropriate) how to qualify for available property foreclosure solutions, like a modification.

Whom need to adhere to which code. Basically, this type of protections and you may servicing loans connect with really mortgage loans, including very first or using liens using one-to-four-product principal houses. (a dozen C.F.Roentgen. ). Specific agencies, in the event, like the Federal Put Insurance Corp., and you can small servicers is actually exempt regarding being forced to comply with specific of conditions.

Another option to get you to stay in our home try refinancing the borrowed funds. You’ll have to believe in your own borrowing and earnings so you’re able to obtain the the brand new loan. The financial institution usually test your earnings, credit, possessions, a position, and you may household record.

For folks who be eligible for a beneficial re-finance, you won’t payday loans in Hanceville just be able to stay-in the house, you will be able to reduce the payment through getting a lesser interest rate or stretching the mortgage label.

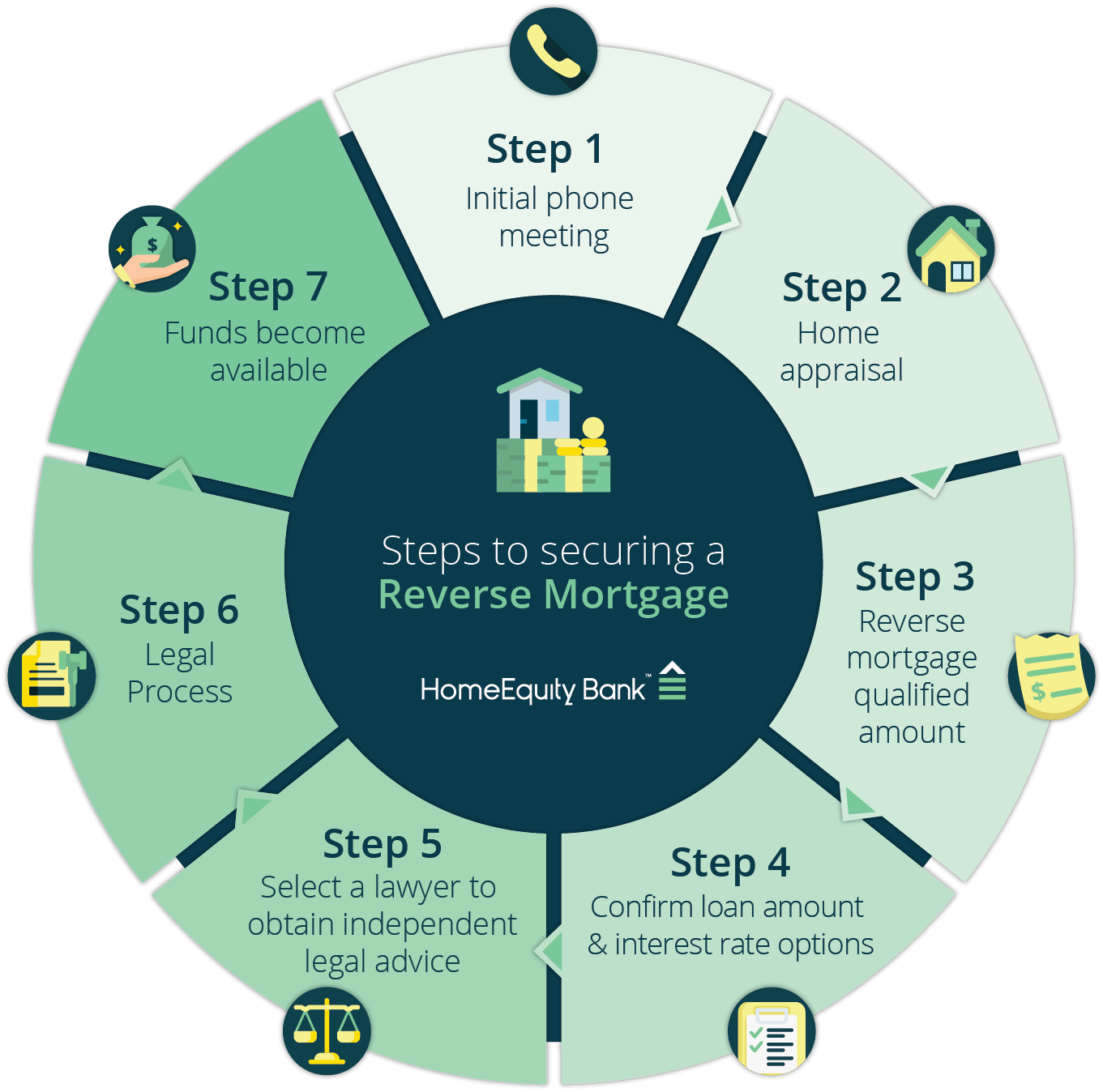

Taking out an opposite Home loan to settle a current Financial Shortly after a partner Dies

In a few items, taking out fully a reverse financial would-be a great way to repay an existing mortgage. However, reverse mortgages are high-risk and you can costly and are generally have a tendency to foreclosed.

Providing Let

Lenders and you may servicers possibly violate the fresh regulations discussed on this page, inadvertently or perhaps purposefully. If you have gotten possessions owing to a heredity or perhaps in among others ways mentioned in this post, your servicer try not wanting to give information about the latest financing otherwise make it easier to, think conversing with legal counsel who will help you about what to complete in your situation.