What direction to go should your USDA Mortgage try Declined

Ultimately, lenders might possibly be remiss if they don’t thought an enthusiastic applicant’s credit history before deciding about their loan application. And just have poor if any credit rating do place an applicant at a disadvantage when someone demonstrates good financial obligation and you will suits all of the other criteria stipulated by the USDA, next their possibility of finding a loan boost significantly.

Which have said so it, other variables instance employment updates, proof citizenship, and you may geographic area may all of the basis into although an candidate can get approval to possess good USDA loan. Therefore, it is critical to consider these items before applying so one can possibly score a precise review of their practical possibility. Thank goodness, more details on what normally hinder otherwise let the job techniques might possibly be browsed on the following part:

Other Factors USDA Loans Rating Declined

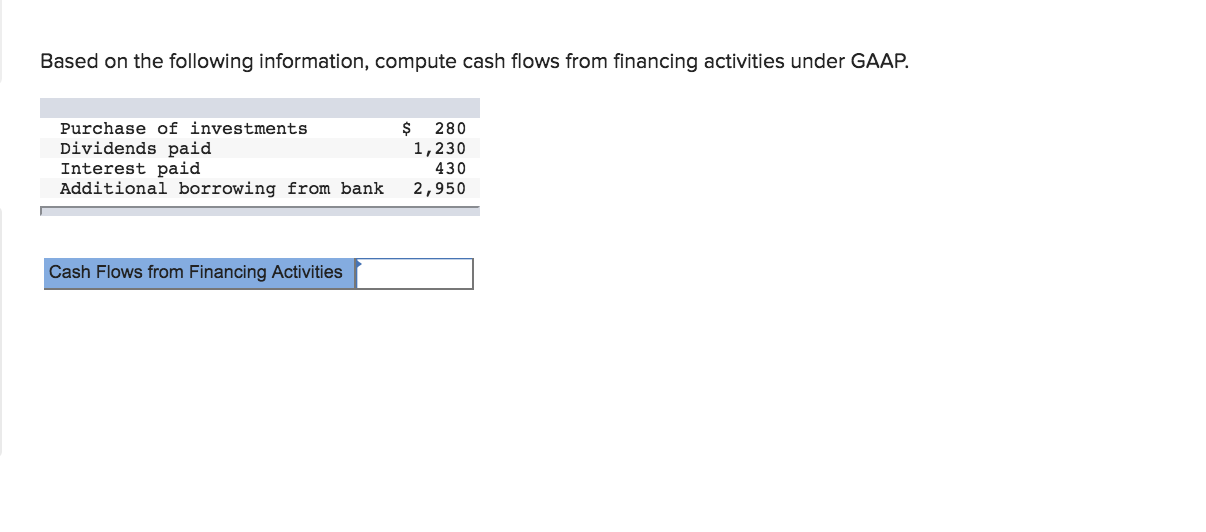

Also income and you may credit standards, there are many most other reason USDA loans can be refused. One reasoning are ineffective guarantee, and therefore the fresh borrower doesn’t have adequate money otherwise property that can be used because security with the financing within the matter-of default.

You should hear more than just the cash and you will credit standards when applying for a USDA financing. Prepare for all potential indicates the loan app will be denied and take protective measures facing them. Like that, you’re certain of their eligibility after you fill out the application and present on your own an informed shot in the getting funding from the usa Institution out-of Agriculture courtesy an effective USDA mortgage. With enough insurance coverage otherwise a safety put is another important factor to take on if you intend to your desire good USDA loan; this can be all of our second material out-of conversation.

Ineffective Insurance rates

Insurance policy is including an important facet within the securing a good USDA loan. Possible consumers need to have adequate hazard insurance coverage, and coverage of any personal possessions, plus enough flood otherwise windstorm insurance rates to afford assets out-of catastrophes. Lenders can be deny USDA loans in the event the potential debtor doesn’t possess sufficient insurance coverage. If you’re not already working with an insurance merchant, we could build information so you’re able to agents who can take care people and make sure this may not be a conclusion your loan would get refuted.

Given that possible individuals understand this a lender could possibly get reject the software getting a beneficial USDA loan, it’s important to understand how they are able to end that it outcome and you can take steps proactively to simply help increase their probability of approval.

- With regards to the U.S. Agencies out of Farming, the most popular reasons for a were unsuccessful USDA loan application were decreased earnings, debt-to-earnings ratios which might be excessive, and you can credit rating or rating circumstances.

- A study conducted when you look at the 2020 found that 24% regarding USDA loan requests was in fact refuted because of credit history circumstances.

- With respect to the National Council off County Houses Agencies, almost forty% of denied applicants lacked enough documents whenever making an application for good USDA loan.

Steer clear of USDA Financing Denial

There are some methods https://availableloan.net/installment-loans-ia/ you could potentially sample don’t be refuted a beneficial USDA. They have been: getting within budget when negotiating that have lenders; comparing loan providers and you will researching their rates; getting numerous rates for several particular insurance rates; and you can contrasting county and you may regional incentives which can be readily available towards buying such dumps and you may repayments. As a mortgage broker, we can help with the new heavy lifting and have your pre-acknowledged getting a beneficial USDA loan rapidly!

The best advice if you’ve been refuted a beneficial USDA financing is to try to step back, review exactly what went wrong (in the event that some thing), learn from those problems, and you can to switch properly moving on. Aren’t getting frustrated! Instead, utilize this experience due to the fact a way to advance ready to accept upcoming software. With careful considered and you may planning, you will want to eventually find achievements during the acquiring their USDA loan for the tomorrow!