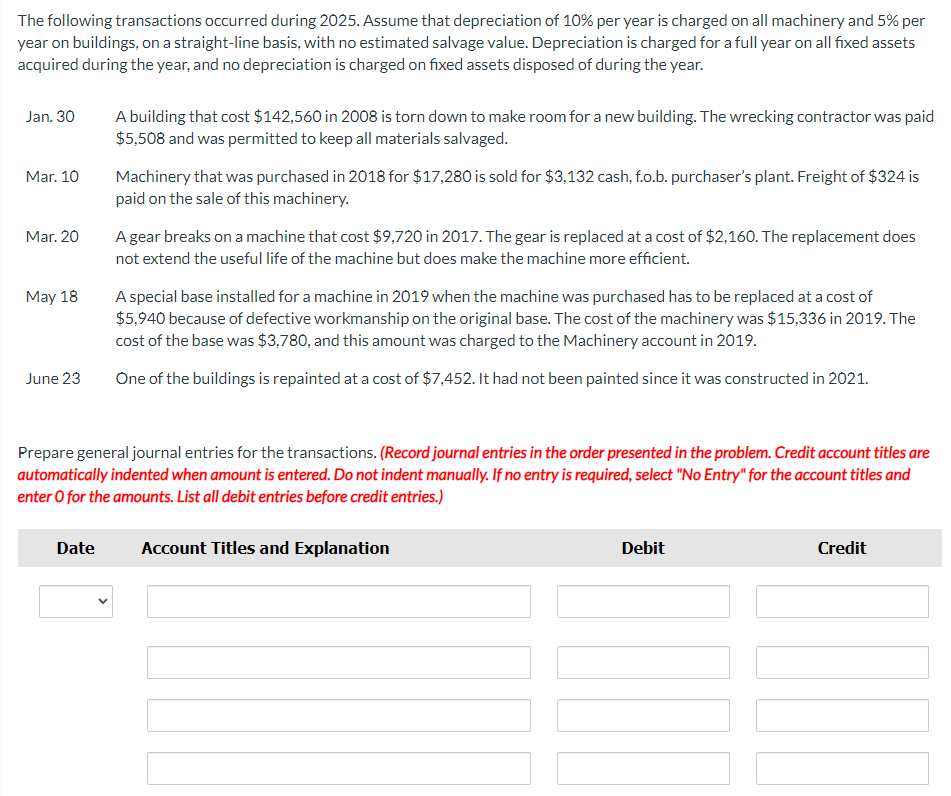

Getting a mortgage in the ten Actions and you may Belongings a good Brand new home

Express

To purchase a house is among the biggest goals from inside the anyone’s life-it’s certainly the highest priced expenditures someone helps make. Therefore, homebuyers will want to strategy people a home purchase with a lot of planning. Whilst it are fun to help you comb owing to house posts, here are a few unlock home, and you will think lifetime for the a property with a well-manicured yard, expansive lawn, and you may progressive kitchen area, it is necessary you to potential customers run getting its resource within the buy firstly.

For many individuals, the largest test it face from inside the to find property is getting a home loan. Since most people don’t feel the methods to pick a house outright, lenders allow more folks to be homeowners. Protecting a mortgage is actually a critical step in your house-purchasing travel, but some basic-go out home buyers will most likely not know how to rating home financing. The mortgage recognition techniques can appear daunting, however with ideal preparation, it does in reality feel a bit painless. By using these types of 10 steps, homebuyers can get a mortgage loan rather than taking on people so many delays otherwise problem.

Before starting…

It isn’t uncommon for people to go to until they would like to generate a deal on the a property first off considering financing, but it will get already getting too-late if that’s the case. Vendors usually wish to know that a purchaser has that loan set up prior to they agree to a deal. That is particularly true in the aggressive real estate markets where suppliers will get discovered several even offers and certainly will manage to become extremely choosy on the going for a purchaser. Providing a good preapproval letter out-of a home loan company before starting brand new house-hunting techniques might be demanded very homebuyers can make an enthusiastic provide out-of a position out of power.

Prospective homebuyers must also prepare by themselves with the thorough financial tests that mortgage preapproval and you may underwriting processes have a tendency to comes to. Providing preapproved to possess a home loan requires a card inquiry, at least, but lenders can also consult shell out stubs, lender statements, or current tax returns to track down a much better sense of a keen applicant’s finances and you will capability to would obligations ahead of taking a good preapproval page.

Ultimately, new procedures detailed below for you to rating a mortgage loan is focused on the process whilst identifies to order a house. Home owners that seeking re-finance its current financial can always use most of these measures because the helpful tips, even though, due to the fact advice concentrating on lender options, loan application, and you will underwriting are also highly relevant to refinancing a mortgage.

Step 1: Work out how much household you can afford.

1st step homebuyers would like to bring whenever preparing to score a mortgage try function a sensible family finances. One of the reasons it is so important to get preapproved in advance of in search of yet another home is that individuals are able to see the fresh new loan amount they be eligible for-and also by extension, exactly how much house capable pay for. Which have this short article in hand assists homebuyers narrow its look and put just the right criterion getting a bona fide estate get.

Before going from preapproval process, individuals could possibly get a much better sense of how much they may be eligible for by using family payday loan Anniston affordability calculators to assess their to buy stamina. This type of on line tools can display what type of financing is possible, but most of the house visitors will have to choose on their own exactly how far these include comfy shelling out for yet another family.

There are many can cost you that go with the to order a home, and additionally right up-front side costs and you can recurring expenditures. Usually, consumers will have to give a deposit towards the a unique home, and that is a lot of currency having to your hands. Home buyers will also need certainly to submit serious currency when and then make a deal into a house, pay money for a home review and you can assessment, and coverage numerous closing costs.