Making use of the fresh Trident Financing Camper Online calculator

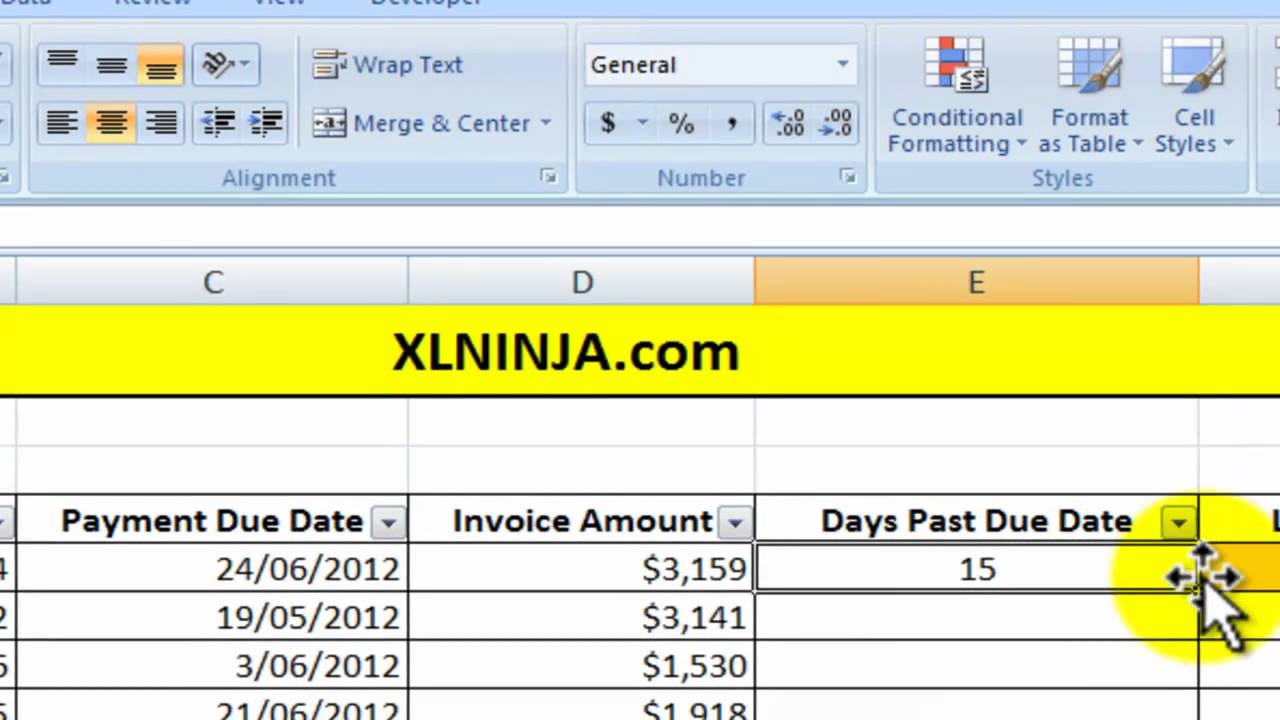

To purchase a keen Rv? Use our very own simple Camper loan calculator to check their monthly payments or determine the total loan amount.

step one. Estimate Your Fee

Whether you’re a professional RVer otherwise new to the newest camping community, it appreciated activity is present to all highway warriors. While you are to order a new otherwise made use of Rv, you should use Trident’s Rv loan calculator understand your financing solutions. Enter the payment you can afford to locate a loan count otherwise offer your own overall Rv amount borrowed to go back your estimated monthly payments.

2. Get a loan

Now that you’ve got an idea of your projected Rv mortgage payment or total loan amount, you could potentially submit the loan app. It takes merely a few minutes! We shall request you to let us know towards type of Rv, rv, or motorhome you’re to get and a few information about debt state therefore we can also be matches you to the fresh new entertainment bank which is most effective for you.

3. Get on the trail!

Once you complete the Camper application for the loan, https://speedycashloan.net/loans/school-loans-for-bad-credit/ all of our devoted group out of mortgage officers gets to works! I often have a response from a leisure bank during the 24-2 days. When we you would like additional paperwork, we shall extend. What you need to carry out was imagine getting a route warrior. We’ll support you in finding the pace and you will Rv mortgage financial that suit your finances and you can lifetime.

Frequently asked questions

You can expect some words ranging from 6 in order to 20 age with regards to the Camper loan amount. Basically, Camper fund range between 10-fifteen years, but the limitation or fundamental title to own an Camper financing can be become affected by the type of Rv you will be capital, brand new Camper design seasons, as well as the usage.

All lenders provides different requirements in terms of resource travelers or motorhomes. The minimum credit rating had a need to see an enthusiastic Camper loan is always 600. Certain lenders will get help you if the score is in the newest large 500s however, expect to pay a much higher attract speed. Having said that, when your credit rating is within the 700s otherwise 800s, there will be more financing products available along with your Camper loan cost would be much more aggressive. Individuals that have lower fico scores can expect a higher Camper financing rate of interest and/or request for a more impressive advance payment of the lender.

Below are a few a rv online calculator, to see how much Camper you can afford. Value depends to your such things as your income, credit score, debt-to-income proportion, cost of your Camper, financing term, and interest rate. When you see the fresh new projected Camper loan payment per month, understand that it does not tend to be insurance, vehicle parking or shop charges, fix, solutions, energy, otherwise permit. So, make certain that discover place on your finances to allow for such even more expenditures.

The lender needs a glimpse a for your total economic profile including your loans-to-income ratio to make sure you can afford to buy the Camper and sustain up with the fresh new monthly payments. The Camper finance calculator is an excellent place to start whenever you will be Rv searching.

You can aquire a keen Camper with less than perfect credit, but you probably won’t qualify for Rv fund for those who have bad credit. In the event your credit score try less than 680, you may need to shell out cash into the Camper, work-out a manager money plan into the supplier, otherwise lay out a big advance payment. Other choices range from taking out a personal loan, delivering that loan out of your borrowing from the bank union, otherwise using Rv broker financing. Certain Rv financing may allow a qualified cosigner although cosigner will have to meet up with the lender’s requirements and you can invest in getting accountable for the borrowed funds.