Restoration Money: In the event that you just take an in-house financing from the repair team?

Show this particular article

People that currently borrowed around the utmost recovery lender loan limitation from $30,000, or individuals who don’t want to pull out a supplementary financial loan, is generally inclined to as an alternative take a call at-family mortgage supplied by the interior structure corporation he has got involved.

cuatro Renovation Companies with in-Home Financing

Although this may seem like a timely and you may easier provider on enough time, taking on instance a loan just to done the renovations will get turn into a bad idea.

In-family restoration money off interior design companies commonly well-known, here are 4 restoration firms that promote for the-domestic recovery loans into the Singapore:

Can i bring an in-home financing out-of recovery providers?

Be careful and sensible inside relates to providing one loan. To not ever move to fast, however,, when you’re considering an in-home renovation mortgage from your indoor developer, never take it up if you do not don’t have any most other choice. The following is as to why.

1. In-mortgage loans are supported by signed up moneylender

To begin with, let’s get one situation upright. So you can legally provide profit Singapore, organizations need sign up for best licences. These types of licences are just booked to have financial institutions, instance banking companies, finance companies and you may subscribed moneylenders.

As a result, design agencies is actually unlikely to have the right licensing to help you provide unsecured loans and their renovation qualities. And also for the rare couple who do, they will certainly more than likely market one another tracts out-of businesses once the hey, it’s a special revenue stream, consider?

If so, how do interior design firms provide you with an in-family recovery mortgage? The most appropriate response is which https://elitecashadvance.com/payday-loans-sc/ they spouse up with an excellent lender, one that is authorized to present unsecured loans towards societal.

You are able you to an inside build firm will get lover right up which have a bank giving its repair financing bundles to help you subscribers however if there are any online, i haven’t heard about all of them.

not, its more inclined the party offering the mortgage are an authorized moneylender. Provided how extremely competitive the subscribed moneylending marketplace is, it’s easy to believe moneylenders partnering with interior decorating providers in an effort to started to much more potential customers.

2. Higher rates

You’ll find nothing completely wrong along with your indoor designer offering that loan away from a licensed moneylender by itself, as long as the brand new moneylender try securely subscribed and in a beneficial updates, you can be positive away from a specialist and you may significantly more than-panel experience.

The issue is that the interest energized from the signed up moneylenders is a lot greater than people charged from the banks and you can finance companies occasionally, without difficulty outstripping your own mastercard rates of interest!

You have to know one to signed up moneylenders are allowed to fees attract of up to cuatro% a month as compared to bank recovery loans that go having ranging from 3.2% so you can 4.55% yearly.

Let me reveal an instant analysis between an authorized moneylender loan and a beneficial financial renovation mortgage, utilizing the particular providers’ on the web hand calculators.

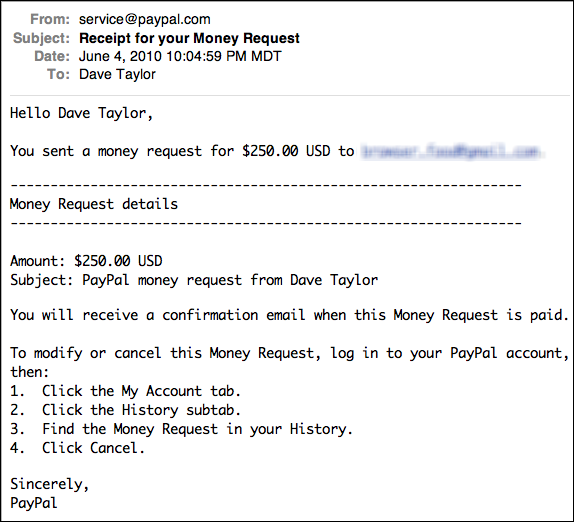

Indoor Creator When you look at the-House Recovery Loan

This really should not be shocking, offered how well-supported the market is actually, that have a good amount of financial and boat finance companies providing well charged renovation financing right here.

Get Repair Loan during the Singapore

Wherever you’re taking your own repair loan off – lender, subscribed moneylender, or the renovation team – you should watch out for the second in terms of a restoration financing provide.

1. Rate of interest

Given that we represented significantly more than, the interest rate with the a remodelling mortgage (otherwise any kind of borrowing, for example) is the unmarried most important factor.

That loan with high interest is much more tough to settle, as well as a speed that’s only somewhat higher can change to help you a positive change in money words.

2. Financing period

Mortgage tenure basically refers to the day you need to pay right back the borrowed funds. Banks generally make you 1 to help you five years on the best way to pay off your repair mortgage. This enables one to pass on the debt away, leading to straight down monthly costs that are better to carry out.

not, observe that the fresh longer you’re taking to pay straight back, the greater amount of month-to-month focus you’re going to have to shell out as a whole. But not, it is far better to determine an extended tenure in order to not excess your self.

Of many registered moneylenders try unwilling to continue a loan period expanded than 1 year, which means your repair mortgage month-to-month money will be really higher maybe even bigger than you might conveniently afford.

Today, if you feel that brand new monthly payments for your restoration financing is just too large, don’t need one restoration loan, because you are in danger off shedding on a debt pitfall, and never-conclude penalty charges.

My indoor designer considering me a call at-household repair loan. How to proceed?

On the unusual possibility your interior creator provides a call at-house renovation financing, make sure to very carefully analysis the conditions and terms of financing, particularly the interest rate and you will mortgage course.

In the event your financial was a good moneylender, you’ll be able to look at the Ministry off Law’s formal directory of registered moneylenders. Make certain the moneylender is not suspended otherwise blacklisted.

While you are becoming told that in the-family financing is out there by the a bank, do not just take your interior designer’s phrase for this. Alone take advice from the bank in question, and make sure the speed, period, charges and fees, or other fine print are the same.

However, for example we told you, in-domestic recovery financing aren’t quite common into the Singapore, which means that your chances of experiencing a person is more likely reasonable.