Many loan providers also provide basic-go out homeowners bonuses and you can special funds

James Chen, CMT is actually a specialist individual, resource agent, and you can international market strategist. He’s got written guides into the technical investigation and you will foreign exchange trading authored by John Wiley and Sons and you can served since the an invitees expert for the CNBC, BloombergTV, Forbes, and you will Reuters certainly one of other financial news.

Information Earliest-Date Homebuyers

As stated above, a first-time homebuyer are a person who sales property getting the very first time. That it residence is deemed brand new homebuyer’s dominating household-the key area that a person inhabits.

Additionally feel known as their number one household or main residence. Keep in mind, in the event, you to definitely a primary quarters might not continually be a real household. For example, it could be a boat that a person schedules to your complete-go out.

The newest U.S. Service from Homes and Metropolitan Development (HUD) develops you to definitely definition even further. Depending on the agencies, an initial-time homebuyer was:

- Someone who hasn’t had a principal quarters to your around three-season several months stop into go out out-of purchase of the newest domestic.

- Someone who has not yet owned a principal home regardless of if the lover was a citizen.

- Anybody who was an individual parent whom had property that have the ex boyfriend-partner.

- An effective displaced housewife which just had possessions with regards to mate.

Somebody who merely possessed property you to wasn’t during the compliance having and should not getting delivered toward conformity which have local otherwise state strengthening rules as opposed to developing a separate long lasting structure.

First-Time Homebuyer Recommendations

First-day homeowners exactly who end up in any of the a lot more than categories can get qualify for certain government-backed programs to provide financial assistance.

Federal Homes www.clickcashadvance.com/payday-loans-il/columbus Administration (FHA) Funds

The fresh Federal Construction Administration assures these mortgage is out there from the FHA-accepted loan providers. The newest agency’s backing also provides loan providers a sheet off cover, so they really won’t sense a loss of profits in the event the borrower non-payments. FHA finance enjoys aggressive interest levels, shorter down money, minimizing closing costs than simply traditional fund.

You.S. Service of Agriculture (USDA)

The fresh new You.S. Agencies off Agriculture’s homebuyer advice system targets residential property in certain outlying parts. This new service claims your house mortgage, so there may be no downpayment needed. While doing so, the borrowed funds repayments is actually fixed.

You.S. Agency out-of Pros Issues (VA)

The latest U.S. Agencies off Veterans Affairs facilitate first-big date homebuyers who are active-obligation armed forces participants, veterans, and you may thriving spouses. Virtual assistant finance promote aggressive rates of interest, need no down payment, plus the Virtual assistant pledges the main loan.

Having good Virtual assistant mortgage, first-day homebuyers are not needed to buy individual mortgage appeal (PMI), and so they do not need to care for at least credit history having qualification. And when the fresh debtor actually is unable to generate repayments towards home loan, the new Virtual assistant is discuss towards bank for them.

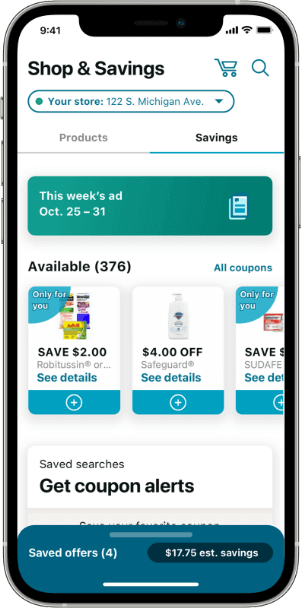

Lender-Provided Benefits

Once the detailed above, particular lenders provide first-time homebuyers which have specific rewards including special money. As an example, first-day homeowners which have low- to moderate-money levels could possibly get be eligible for grants or loans that do not need payment for as long as the new borrower remains at home to possess a specific period of time.

Closure pricing assistance may also be available to particular somebody based to their things. Each one of these choices are provided as a consequence of bodies-sponsored programs. Qualifications varies centered on homebuyers’ credit scores, earnings accounts, and you can local requirements.

If you think you’ve been discriminated facing from the a lending company based on competition, faith, gender, marital standing, access to personal direction, national origin, handicap, or many years, you can document a research for the Individual Monetary Security Agency otherwise HUD.

Special Factors

An initial-go out homebuyer could possibly withdraw off their individual old age account (IRA) rather than running into the first-delivery punishment, and therefore pertains to IRA withdrawals one to exist before IRA owner has reached 59.5 years dated.

The acquisition does not need to become a vintage household to own the given individual to qualify while the a primary-go out homebuyer, but it ought to be the dominating household. Such as for example, it could be good houseboat which you decide to have fun with as your main home.

The maximum amount that is certainly marketed regarding the IRA to the a penalty-100 % free basis for which goal are $ten,100. This is a lives limit. To own maried people, the fresh restrict applies alone every single partner. This is why the fresh shared limitation getting a married couples is $20,one hundred thousand.