What Experts Need to find out Prior to purchasing The Very first Home

Just like the a first-go out homebuyer, the process can be overwhelming and you will perplexing. At the HomePromise, our Virtual assistant loan advantages has prepared this informative article for you. If you find yourself a dynamic armed forces representative or experienced browsing buy a property next month or two, this post is for your requirements.

HomePromise gets the recommendations try to be confident when purchasing your earliest home. We could assist you with very first-time home-to invest in trip in addition to Va mortgage items. We know the newest Virtual assistant mortgage program and can direct you from closing process. We can including give an explanation for Virtual assistant resource percentage and you can what qualifies having a different.

With regards to to invest in a home the very first time, experts has actually a bonus within the obtaining a good Virtual assistant financing. A great Virtual assistant financing is a mortgage loan offered by personal loan providers, eg HomePromise.

As opposed to FHA funds, a Va loan was guaranteed by Agency out of Veterans Activities (VA). As a result given that a seasoned, you can enjoy positives instance a zero down-payment specifications minimizing rates for people who qualify.

Virtual assistant fund not one of them individual mortgage insurance (PMI). This is different from traditional financing. You will be able having many (if not plenty) from dollars to get spared by applying your Virtual assistant financial work for.

Simultaneously, there’s absolutely no prepayment penalty for paying the Virtual assistant financing very early, providing alot more liberty within the managing your finances.

To be qualified to receive an effective Va mortgage, you should very first satisfy certain requirements. They truly are offering about 90 successive times of energetic duty while in the wartime, or 181 months throughout the peacetime. Additionally, you will need get a certification from Eligibility (COE) on the Va before applying to your loan. HomePromise helps you accomplish that easily because of the contacting 800-720-0250.

This new Virtual assistant Financing Processes

It is essential to keep in mind that while you are there are various advantages to bringing a good Virtual assistant financing, there are even certain restrictions. Va financing limitations can be placed precisely how much you could use. The fresh limitations differ by condition and you may state in addition they can alter every year.

This new Virtual assistant loan techniques are created specifically making it easier for veterans buying the basic household. First, you should get pre-eligible to a great Va loan by proving proof of the armed forces service and money in order to a beneficial Va bank such as for instance HomePromise.

To find out if your qualify, HomePromise will consider carefully your credit history, debt-to-earnings proportion, along with other factors. And additionally, phone call HomePromise 800-720-0250 as they possibly can see their COE rapidly and, view their borrowing capacity.

After you find the appropriate house that fits within your budget, it’s time to submit a deal. Your own realtor will help your inside the discussing for the seller. They’ll make certain that all the required actions is actually drawn just before proceeding for the get.

After your own give has been acknowledged, get in touch with HomePromise to begin with financing running. A great Virtual assistant house assessment needs lay next.The brand new appraiser will ensure the house have to fulfill conditions lay because of the Va. Some of these criteria protect you from buying a home which have issues.

What you need certainly to listed below are some about how to move on to the latest underwriting stage having HomePromise. Right here, all of your monetary pointers might be affirmed once again. When underwriting is performed, you will receive acceptance.

Next, it is the right time to intimate. This is when you indication the required documentation and you may import new fund towards the settlement representative.

So now you was theoretically a citizen! Yet not, working with this new Virtual assistant mortgage gurus in the HomePromise can lessen some of one’s pressure and uncertainty.

The latest Closure Procedure

Closure toward a property might be a captivating milestone. Yet not, it could be daunting to possess very first-time consumers. Finding the time to understand the method might help relieve the stress out-of closing.

HomePromise will give you a closing Disclosure before closing date so you can review will set you back and you will loan terminology an added time. So it file outlines all of the will set you back mixed up in financing and you will reveals the loan count, rate of interest, financing identity and you may projected closure time. Make sure you opinion it file very carefully so are there no shocks towards closure go out.

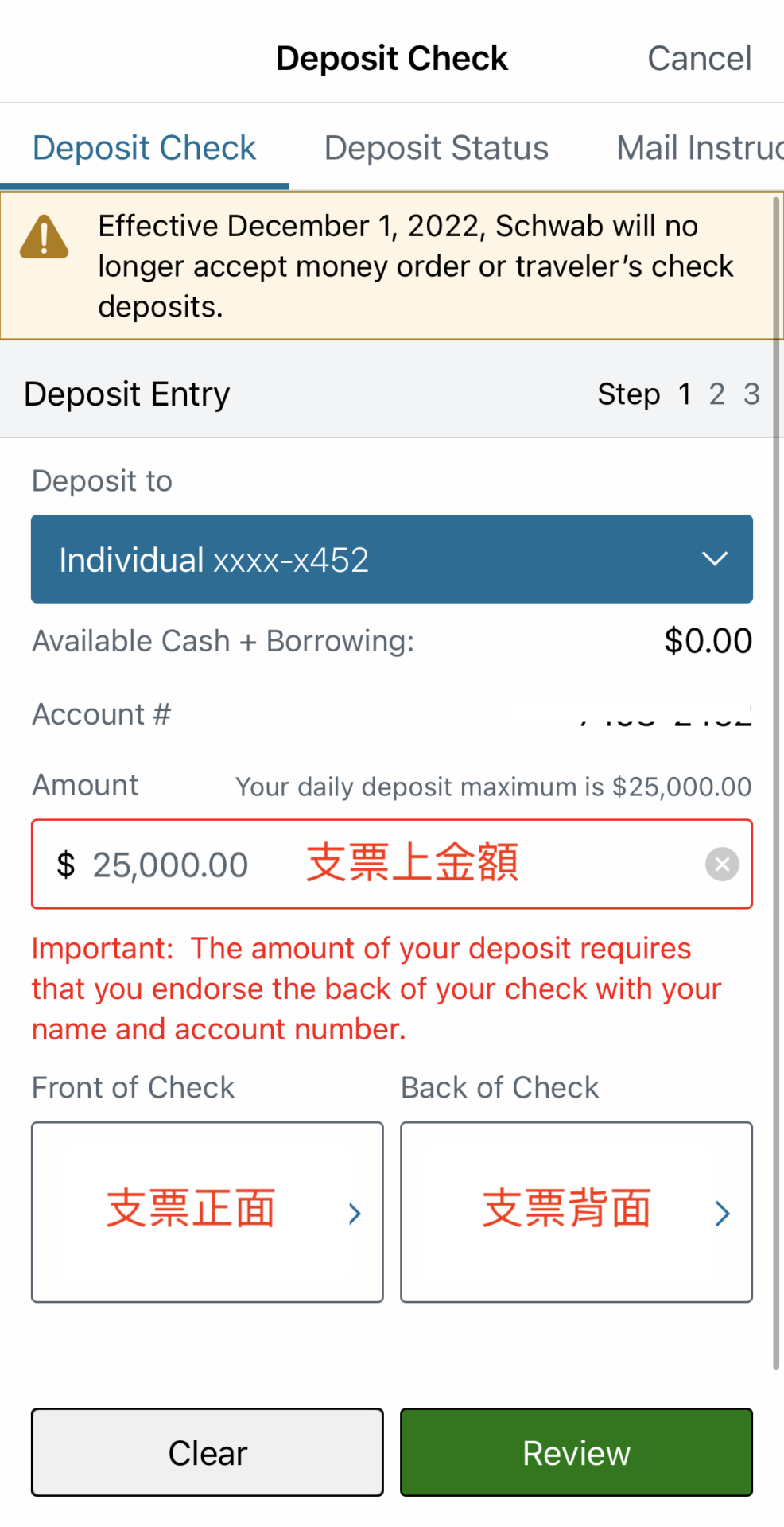

At the time from closure, give a couple different personality and you can any additional files their financial possess expected. The settlement broker may want an authorized otherwise cashier’s view for any left financing owed on closing. Often you are able to cord financing having closing.

From inside the genuine finalizing, spend your time examining for every single document, and don’t hesitate to make inquiries if anything is not obvious. Just after everything has come signed and accepted, well-done!

Shortly after finalizing, there will nevertheless be specific blog post-closing opportunities like move resources and repairing files signed from the closing, or no. However now you could enjoy having your personal bit of home!

Things to consider When buying a house the very first time

Pros have many positives. There are facts to consider when purchasing property the very first time. Including, are you economically able to have homeownership?

Make sure you take some time wanted to save your self adequate money to possess closing costs. Consider the monthly mortgage payments and any possible repairs or restoration will cost you also.

Remember that closing costs is generally paid back from the provider or creator. You should learn more about just who pays this new settlement costs for the Virtual assistant money .

To invest in a home the very first time as an experienced or active army affiliate can seem overwhelming initially. Capitalizing on Va finance might be an installment preserving and you may effortless feel when buying your first house.

Think about your funds when creating behavior. Manage new Va financing benefits on HomePromise from the 800-720-0250. They understand the unique challenges against experts and you will productive obligation solution participants.

Virtual assistant money require no deposit and just have competitive rates of interest. So it merchandise experts it is able to pick a home instead of investing a great deal.

Virtual loans Bell assistant Debt consolidating Loans & Army Debt consolidating

Even after the very best of motives, costs can start in order to accumulate. From unforeseen scientific expense to help you high notice playing cards, obligations can take place so you can individuals. Most other expenditures particularly educational costs, unpaid fees, and you can next mortgages also can result in monetary be concerned. To have experts and you can military group currently experience financial hardships, Va armed forces debt consolidation finance will help.